January 8, 2026

Button Finance Inc. Chief Executive Officer Jason Harris discussed home-equity originations, pricing dynamics and capital markets in an interview last month, while outlining how the firm's new technology strategy and product expansion into first liens that don't meet Qualified Mortgage standards are expected to support the company’s next phase of...

January 7, 2026

Three providers of equity-sharing products are looking to fill impactful roles including a marketing executive, an associate general counsel and an investment strategist. Compensation for one of the roles surpasses $300,000.

January 6, 2026

Shellpoint Partners LLC continued to dominate quarterly grievances about home-equity products, though the servicer reduced the count by over a fourth from a year earlier. One of two complaints filed against providers of home-equity investment contracts alleged misleading marketing.

January 5, 2026

Investor appetite shifted across segments of the home-equity market during 2025, with securitizations of home-equity investment contracts absorbing weaker credit scores, while bonds backed by home-equity lines of credit reflected higher leverage mitigated by modestly improved credit scores.

January 2, 2026

Quarter-over-quarter growth emerged in online searches tied to home-equity investment products, while second mortgage inquiries posted a year-over-year gain. Banks continued to dominate overall home-equity results, though fintechs, credit unions and traditional mortgage lenders also placed.

Pools from an upcoming bond issuance dominated by closed-end second mortgages originated by loanDepot.com LLC and PennyMac Loan Services LLC carry a notably lower weighted-average coupon even though the underlying collateral lacks the type of credit enhancements that typically accompany lower pricing.

Low coupons define the opening home-equity securitization of the year, as Cerberus Capital Management LP brings a closed-end second mortgage transaction to market with collateral metrics that remain closely aligned with prevailing credit risk standards.

Year-end activity in the home-equity securitization market included a record-setting home-equity investment deal alongside two largely first-lien residential mortgage-backed securities that incorporated limited volumes of junior liens.

January 5, 2026

A broad dispersion of coupons accompanied three bond issuance featuring loans that fall short of Qualified Mortgage requirements with differing combinations of leverage, borrower credit profiles and cash-flow characteristics.

January 2, 2026

Weighted-average coupons on home-equity line of credit and non-QM bond issuances moved lower in December, while closed-end second and jumbo transactions posted modest increases. More signficant was the quarterly HELOC WAC -- which sank 185 basis points on a year-over-year basis.

January 1, 2026

Issuance of jumbo residential mortgage-backed securities accelerated into year-end, with a cluster of late-quarter transactions led by affiliates of JPMorgan Chase & Co. and capped by a Goldman Sachs Mortgage Co. deal that closed on the final day of the year.

January 1, 2026

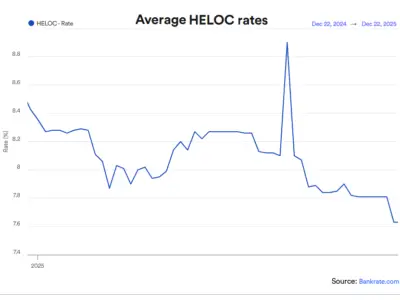

During 2025, interest rates on open-end home-equity products tumbled nearly three-quarters of a percentage point, while averages on closed-end junior liens dropped by around half that much.

December 30, 2025

As monthly securitizations of closed-end junior lien and home-equity agreement bonds slipped, open-end issuance surged 43% and skyrocketed 295% from a year earlier. Annual home-equity issuance nearly doubled, with closed-end transactions driving dollar volume higher and open-end deals delivering the largest percentage gain.

The HELN Newsletter

July 2, 2025

By COVIANCE Community home-equity lenders have a timely opportunity—but seizing it requires a more strategic approach. Success will come from moving beyond mass marketing, delivering personalized messaging, and simplifying the borrower experience.

November 21, 2025

By MICHAEL MICHELETTI Equity-sharing products make up a rising proportion of home-equity originations, and further expansion appears likely as easier equity extraction, intensifying institutional investor demand, and the appeal of having no monthly payment continue to pull more homeowners toward...